While you’re buried in paperwork filing the same claim for the third time, your competitor just processed 100 claims automatically—before lunch. The gap is widening. Want to catch up?

Is the notion that claims processing must remain labor-intensive and paper-heavy actually true in today’s digital landscape? You’re likely processing thousands of claims manually while your competitors automate claims processing with solutions that cut processing times by 80% and reduce costs by 30%. This operational gap doesn’t just impact your bottom line—it’s widening daily as customers increasingly expect instant resolution. The path forward requires strategic technology integration, but where should you begin?

Key Takeaways

- Implement AI and OCR technologies to reduce manual data entry by 80% and cut processing times by 60%.

- Automate routine claims through straight-through processing, achieving 70-85% touchless handling rates.

- Invest in intelligent document processing (IDP) to transform unstructured data, reducing document management costs by 80%.

- Prioritize high-volume tasks for automation while maintaining human oversight for complex claims.

- Integrate self-service portals and real-time updates to enhance customer experience while reducing operational costs by 30%.

The Shocking Cost of Manual Claims Processing

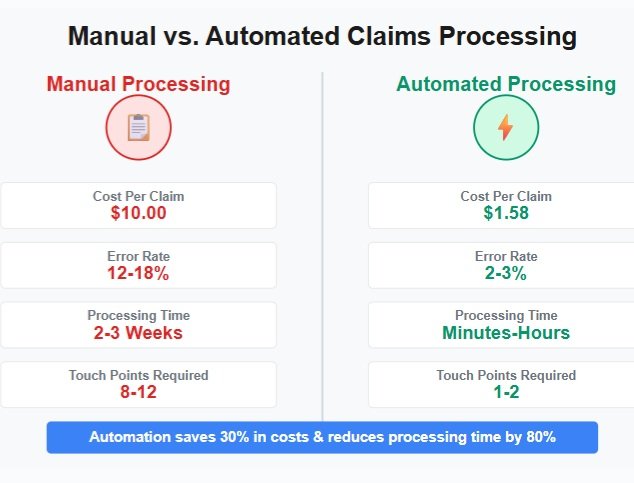

Your organization faces staggering error rates of 12-18% with manual processing, causing $17 billion in annual losses.

Manual errors trigger 25% of claims needing correction at $25 each. Healthcare organizations implementing comprehensive automation report average savings of $2.8 million annually through elimination of these errors. A thorough cost-benefit analysis post-automation will reveal significant efficiencies and substantial long-term savings.

Your labor costs run 2-6 times higher than automated alternatives, with manual claims costing up to $10 per claim versus $1.58 for automated ones.

Claims follow-ups and denial management consume valuable staff time. Manual claims processing incurs heavy operational costs due to labor-intensive procedures that could be eliminated through automation.

Operational inefficiencies extend reimbursement cycles by 30 days, compromising cash flow and creating compliance issues that threaten your financial stability.

Get a free 30-minute consultation to identify which claims processes are costing you the most—and how automation can recover those losses in under 90 days.

Automate Claims Processing: Industry Benchmarks

Based on data up to October 2023, automated claims processing now reaches impressive adoption rates, with 80% of insurers implementing generative AI by 2025 for various processing functions. Claims automation delivers processing speeds up to 10 times faster than manual handling, with leading carriers cutting handling times by up to 50%. These technologies consistently yield 25-30% cost savings while boosting productivity by up to 25% through streamlined workflows and reduced manual bottlenecks.

The integration of OCR and IDP enables insurers to automate claims processing by rapidly digitizing and validating claim documents, further accelerating the entire process. N8N workflow structure allows for designing modular workflows that facilitate seamless automation, and many carriers are reporting a 20-25% reduction in loss-adjusting expenses while simultaneously enhancing customer experience through AI implementation.

Current Adoption Statistics

The insurance industry has embraced claims automation at a remarkable rate, with 82-84% of insurers now having adopted or actively deploying AI-driven solutions in their claims processing workflows. You’re part of an industry transformation where adoption trends show 76% of carriers implementing generative AI across underwriting and claims functions. The implementation of advanced AI systems has resulted in processing costs dropping by an average of 30% for insurers utilizing automation technologies. These AI systems have demonstrated remarkable efficiency in damage assessments, achieving 95% accuracy when utilizing computer vision technology.

| Key Adoption Metric | Current Percentage |

|---|---|

| AI-processed claims volume | 31% |

| Mobile app availability | 94% |

| Efficiency improvement reports | 75-90% |

| Initial inquiries automated | Up to 70% |

| Fully scaled AI systems | 7% |

These industry insights reveal high adoption momentum despite scaling challenges remaining.

Processing Speed Improvements

Beyond adoption rates, processing speed stands as a critical performance indicator for claims automation systems. You’ll experience dramatic efficiency gains when implementing these solutions—reducing claim processing time by approximately 80%.

Your organization can achieve 30% faster recovery times through automation compared to manual workflows. AI-driven platforms transform weeks-long processes into hours, while enabling straight-through processing rates of 70-85% for routine claims.

These speed enhancement benefits derive from intelligent technologies that streamline document processing, automate fraud detection, and eliminate administrative bottlenecks. Automated OCR technology converts physical paperwork into digital formats, drastically reducing manual data entry requirements. Smart forms guide users through each step of the claims intake process, ensuring accurate information collection from the start.

With reduced errors and 80% less rework, your teams can focus on complex cases while automated systems handle high-volume tasks.

Cost Reduction Impact

While processing speed gains deliver operational efficiency, cost reduction represents the most compelling business case for claims automation implementation. Your organization can expect 30% lower processing costs through reduced manual labor and streamlined workflows.

The cost benefit extends beyond immediate operational savings. Automation decreases manual data entry by up to 80%, improves loss ratios through more precise claims adjudication, and reduces fraudulent payouts by 40%. Implementing automated solutions helps address the challenge that claims processing accounts for approximately 70% of insurers’ overall costs. Workflow automation enhances the accuracy of data handling and decision-making, further contributing to these savings.

Your efficiency metrics will reflect productivity increases of approximately 25%, with leading adopters achieving 10x faster processing. Continuous processing significantly reduces settlement times while ensuring accuracy.

These financial improvements enable budget reallocation toward customer-centric activities, strengthening your competitive position in the industry.

5 Key Technologies Transforming Claims Processing

Five transformative technologies are revolutionizing claims processing across the insurance industry today.

AI advancements enable automated data extraction from unstructured documents, reducing processing times by up to 60%.

AI extracts data from unstructured documents automatically, slashing processing times by up to 60%

RPA efficiencies digitize repetitive tasks like data entry and payment processing, while IDP benefits transform unstructured data into standardized formats, cutting document costs by 80%. Customer experience is significantly improved through faster communication and reduced back-and-forth for information verification.

Fraud detection and predictive analytics flag suspicious claims early, expediting legitimate ones. This enhances overall accuracy in payouts while minimizing risks of fraudulent claims.

Cloud integration provides seamless connections with existing systems, ensuring automation scalability to handle volume fluctuations.

Together, these technologies reduce operational costs by approximately 30% while considerably compressing processing times.

We’ll design a custom workflow that connects your existing tools—no system replacement required. See exactly how intelligent document processing can work in your agency.

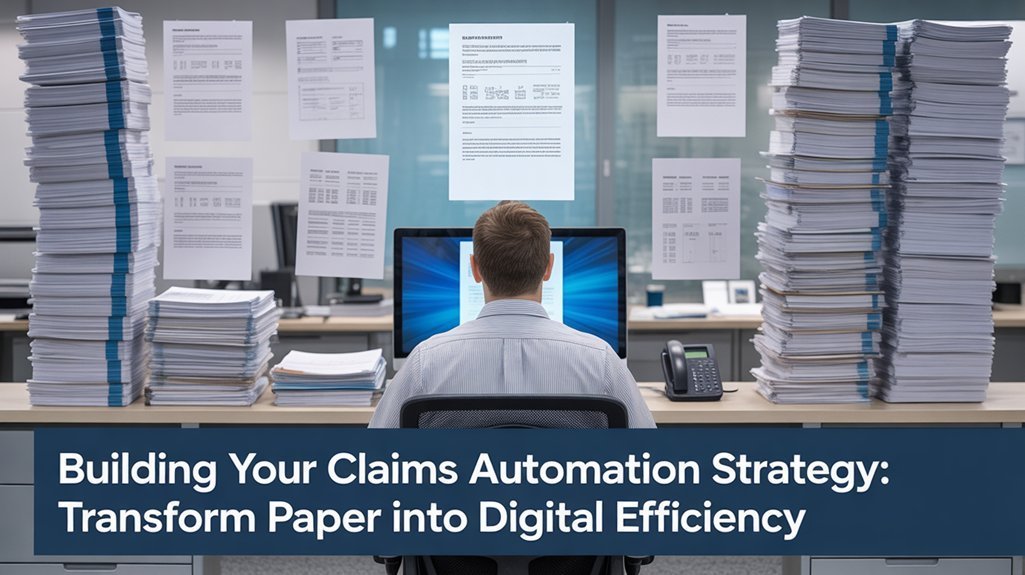

Building Your Claims Automation Strategy

Developing an effective claims automation strategy requires methodical planning and execution across multiple dimensions. Start by defining clear automation objectives aligned with your business goals, then conduct thorough process mapping to identify high-impact opportunities. Selecting claims management software that integrates seamlessly with your legacy systems for maximum operational efficiency is essential, as proper API call batching can reduce network overhead and enhance overall workflow performance. Prioritizing high-volume, repetitive tasks can yield up to 80% reduction in processing errors when implementing claims automation.

| Phase | Focus Area | Success Factors |

|---|---|---|

| Planning | Business Objectives | Measurable KPIs, aligned priorities |

| Assessment | Process Mapping | Data readiness, system integration |

| Team | Cross-Functional Experts | Clear ownership, governance structure |

| Implementation | Phased Rollout | Training, change management, feedback loops |

| Optimization | Compliance & Monitoring | Regulatory alignment, performance tracking |

Assemble a diverse team to drive implementation, ensuring representation from claims, IT, and compliance. Begin with high-volume, low-complexity processes to demonstrate quick wins before scaling to more complex workflows.

Real-World ROI: Financial Benefits of Automated Claims

You’ll see ROI as high as 245% within 12 months of implementing claims automation, with typical payback periods of 6-12 months.

Cost reductions can be substantial, with per-claim processing costs dropping from $50 to $20, generating $300,000 in annual savings for every 10,000 claims processed.

These financial benefits compound over time as your organization processes more claims with fewer resources, handles volume spikes efficiently, and reduces fraud payouts through improved detection mechanisms. Our client experienced a remarkable 62% reduction in claims processing time, decreasing from an average of 3 days to under 1.1 days. Traditional enterprise integration costs can be dramatically reduced by up to 90% reduction with modern claims platforms that feature developer-friendly APIs.

Cost Savings Analysis

The compelling financial case for automated claims processing emerges clearly when examining real-world return on investment data. Your cost benefit analysis reveals dramatic savings: manual processing costs $2.05-$10.00 per claim versus $0.85-$1.58 for automated systems—a 2-6x efficiency advantage.

Efficiency metrics demonstrate that automation cuts administrative costs by 13-25% while reducing overall operational expenses by 30%. For a 200-bed hospital, this translates to $2.8 million annual savings, or approximately $14,000 per bed. Systems experiencing high traffic may face processing delays similar to server connection issues, making automation even more valuable during peak periods.

AI-based systems further reduce denial resolution costs from $40 to under $15 per account, creating multimillion-dollar savings for mid-sized providers. The market for insurance claims automation is expanding rapidly, with projections showing growth from $514 million in 2024 to $2.76 billion by 2034.

Accelerated ROI Timeline

While cost savings create a compelling case for claims automation, the speed at which these investments pay for themselves makes them even more attractive. Your organization can expect significant ROI within 6-12 months when implementing targeted Claims Efficiency strategies. The Pillar 3: Cost & ROI framework demonstrates that automation leads to significant operational efficiency gains alongside improved employee satisfaction.

| ROI Timeframe | ROI Strategies |

|---|---|

| 6-9 months | High-volume, low-complexity claims automation |

| 9-12 months | End-to-end processing implementation |

| 12-18 months | Thorough system integration |

| Ongoing | Continuous optimization and scaling |

Early adopters report ROI of 195-300% within 18 months, with faster claims processing driving 762-point higher satisfaction scores. You’ll join industry leaders achieving 25% productivity increases through strategic automation implementation.

From Weeks to Minutes: Speed Improvements Through Automation

Insurance claims processing has undergone a revolutionary transformation through automation, reducing turnaround times from several weeks to mere minutes for routine claims.

You’ll experience claims efficiency improvements of up to 50%, with AI-powered systems operating 10 times faster than manual processes.

Your team can leverage processing innovations that extract and interpret 70% of claim documents in near real-time, drastically accelerating decision-making.

Robotic process automation handles repetitive tasks throughout the entire claims lifecycle, enabling you to settle claims in days rather than weeks, keeping your customers satisfied and your operations streamlined. Automated fraud detection systems identify suspicious claims 50% faster, significantly reducing fraudulent payouts and protecting your company’s bottom line.

How Customer Experience Transforms With Automated Claims

Beyond impressive speed improvements, automated claims processing fundamentally reshapes your customers’ journey from first notice of loss to settlement. Your team gains the ability to provide real-time updates while delivering personalized service that builds loyalty.

| Experience Element | Customer Impact |

|---|---|

| Real-time updates | Eliminates uncertainty and waiting anxiety |

| Self-service portals | 24/7 access on customers’ terms |

| Personalized interactions | Stronger emotional connection to your brand |

| Reduced errors | Enhanced trust in your competence |

| Automated feedback collection | Continuous improvement driven by user experience |

Customer feedback demonstrates that accuracy and transparency aren’t just operational metrics—they’re emotional touchpoints that determine whether policyholders stay or leave. Your automated system transforms frustration into satisfaction.

Common Pitfalls When Implementing Claims Automation

When implementing claims automation, you’ll likely encounter data quality issues where incomplete or inaccurate information derails processing efficiency and leads to erroneous decisions. Employee resistance to change presents another significant obstacle, often stemming from inadequate training and fear that automation will eliminate jobs. Technology integration challenges arise when attempting to connect new automation tools with legacy systems, creating workflow disruptions and redundant processes that diminish expected productivity gains. Additionally, addressing authentication and API credential failures is crucial for ensuring seamless integration and functionality in the automation process.

Data Quality Issues

Data quality represents the cornerstone challenge in claims automation implementation, with 64% of organizations citing it as their primary obstacle to data integrity.

Poor data quality costs you 15-25% of total revenue through inefficiencies, overpayments, and claims leakage.

When implementing claims automation, you’ll face three critical data challenges:

- Cross-organizational dependencies requiring provider collaboration for verification

- Inadequate data validation techniques causing NPI mismatches and patient status inconsistencies

- Incompatible data governance practices leading to definition discrepancies across systems

Without regular quality checks, errors compound over time, degrading your automation performance and eroding stakeholder trust—a problem affecting 67% of organizations in your industry.

Resistance to Change

Resistance remains the most persistent barrier to successful claims automation, with 58% of professionals reporting low confidence in utilizing new AI tools. You’ll face employee concerns about job security and change fatigue when implementing new systems without proper communication.

| Training Strategies | Employee Concerns | Mitigation Approaches |

|---|---|---|

| Role-specific training | Job security fears | Human-in-the-loop design |

| Continuous education | Change fatigue | Phased implementation |

| Hands-on workshops | Feeling undervalued | Frontline staff involvement |

| Support resources | Skill obsolescence | Clear communication of goals |

Address misalignment between leadership priorities and staff needs by involving frontline employees in planning phases. Remember that 40% of respondents consider human oversight business-critical, emphasizing the importance of augmentation rather than replacement.

Technology Integration Challenges

Despite significant investments in claims automation technology, organizations frequently encounter integration challenges that undermine efficiency gains.

Your success depends on addressing these fundamental barriers:

- Legacy system compatibility issues affect 65% of claims professionals, creating workflow friction and data silos that prevent straight-through processing.

- Data quality management requires validation checks and standardization to reduce errors when processing unstructured inputs like handwritten notes or scanned documents.

- Complex exception handling necessitates well-designed integration strategies that balance automation with human oversight for nuanced claims.

Without addressing these challenges, you’ll continue experiencing disconnected workflows and unrealized automation benefits.

Future-Proofing Your Claims Process

As technological advances continue to accelerate, future-proofing your claims processing infrastructure requires implementing a strategic blend of AI, machine learning, and emerging technologies.

Your future readiness depends on embracing hyperautomation that interconnects the entire claims lifecycle.

Invest in IoT and telematics for real-time data collection while implementing blockchain to reduce fraud by up to 40%.

Prioritize data quality—clean, organized inputs are non-negotiable for automation success.

Map your current workflows thoroughly before technology adoption.

Remember that self-service portals and AI chatbots not only improve customer satisfaction but also free your team from routine inquiries, positioning your organization for sustainable growth in the digital claims ecosystem.

Getting Started: Your 90-Day Automation Roadmap

While initiating your claims automation journey may seem overwhelming, breaking it down into a structured 90-day roadmap makes the process manageable and strategic.

Transformation starts with structure—turn complexity into clarity with a strategic 90-day automation roadmap.

Overcome automation challenges by following this proven approach:

- Weeks 1-4: Map existing workflows, collect baseline data, and identify high-impact automation opportunities with clear stakeholder engagement and accountability assignments.

- Weeks 5-8: Develop your phased strategy, select technology partners, and launch controlled pilots focused on document-heavy processes like intake and validation.

- Weeks 9-12: Scale successful pilots across departments while continuously monitoring KPIs including cycle time, error rates, and cost reduction.

Join insurance agencies already saving 30% on claims processing. Book a strategy call to map your current workflows, identify quick wins, and get started with proven automation solutions built specifically for insurance professionals.

Frequently Asked Questions

How Does Claims Automation Impact Data Security and Compliance?

You’ll strengthen data security through automated encryption and anomaly detection, while ensuring compliance standards are met with automated audit trails and consistent regulatory adherence across all claims processing workflows.

Can Small Insurance Companies Afford Claims Automation Technology?

Yes, you can afford claims automation through scalable SaaS options, pay-per-use models, and cloud-based solutions. Your cost analysis will show 25-30% operational savings offsetting initial technology adoption investments.

What Skills Will Claims Staff Need in an Automated Environment?

You’ll need analytical skills and technological proficiency to excel. Master claims software, data analysis, automation tools, exception handling, and decision-making while adapting to evolving systems and maintaining attention to detail.

How Do You Manage Exceptions When You Automate Claims Processing?

You’ll need integrated exception handling systems combining AI-based categorization, human-in-the-loop protocols, and workflow automation tools. Address automation challenges by establishing clear escalation pathways, audit trails, and continuous feedback loops for improvement.

Will Claims Automation Work With Our Legacy Systems?

Perfectly possible with proper planning. You’ll need middleware solutions to manage legacy integration challenges. Your existing systems can connect to automation tools through APIs or custom interfaces for seamless workflow enhancement.

Do You Automate Claims Processing As Much As You Should?

You’re just one click away from transforming your claims operation. Start by auditing current processes, selecting appropriate technologies, and training your team. Implement changes incrementally to avoid workflow disruptions. Remember, Rome wasn’t built in a day, but your automation strategy can be implemented in 90. Track ROI metrics carefully to demonstrate value and continuously refine your approach for maximum efficiency.